July 2023 Market Update

Over 339,000 jobs were created in the United States in May of this year. How does that affect real estate? Keep reading to find out.

Well, jobs are the big topic of discussion right now as the U.S. watches that unemployment rate like a hawk. What they're doing right now is they're looking at inflation and they're looking at how to control it. But one thing that is keeping inflation not under control is THE UNEMPLOYMENT RATE.

There are over 10 million jobs available right now. That means for every unemployed worker, there are 1.6 jobs available which means that prices and wages keep escalating. Now, what ends up happening if we can't get this under control? Well, eventually a wage and price spiral starts to occur, and it's even harder to get inflation under control.

Well, why does that matter for Real Estate?

Honestly, if you're watching a real estate market update, it means this; prices are going to continue to escalate for homes as long as workers can continue to pay the prices of these increasing interest rates. That means that if wages do increase by 4% and prices subsequently follow, we're seeing this wage and price spiral that continues to occur.

If we look back to December of 2022, and we look at some of the predictions that were made even by us here or economists nationwide, we saw varieties of predictions from decreases in prices down 20 percent, all the way to single-digit appreciation, which is what we indicated.

Well right now, what's happening? Single-digit appreciation for most areas across the country, and why is that? It's simply due to there not being enough houses. So this month's market update is all about NEW CONSTRUCTION. New construction has been a topic that many people have not broached for quite some time. Why is this? After 2008, many builders actually went out of business. So what ended up happening was all the new inventory or new homes that needed to be built for a growing population stopped happening, or let's just say, extensively slowed down.

So now we're at a point over 15 years later, where we really do need those new homes to have been built and we need even more homes and now we're at a deficit of still about five million homes throughout the United States.

What does that mean for retail pricing?

Meaning homes that are already built. Those prices continue to escalate and right now, all of the focus is on new construction right now. So what does this all mean for existing home sales and new construction? Well, existing home sales are actually down 20 percent so far this year. In fact, in many areas around the country, they're down about 40 percent. That's incredible, that just simply means and as a result, not many sellers putting their homes on the market, so there's just not the amount of homes in order to resell.

New construction on the other hand is up 20%. That means that many home buyers and even sellers who want somewhere to move, but don't see a house that they can move to are calling builders so that they can find a place to build the house that they actually want, even if they have to wait a longer period of time and even if it costs a little bit more money. Now, why are they doing this? Well, if you're not familiar with many new construction lending products, you can actually build a home right now and have your interest rate at a certain amount and only pay the interest on that loan. Meaning you'd only pay whatever the bank would charge you for that loan without any principal, why would you do that? Well, during the course of the construction of the property, many times an interest-only loan will allow you to keep your payment as small as possible while the property is still being built. Then when the property is built, you're able to put your home on the market and many sellers are seeing a really high return on their investments of their existing home because the market has been so hot.

So what happens to all the costs of this new construction?

Well yes, prices have escalated since Covid and homes do cost a bit more to build. However, in contrast to the rising prices of existing homes, it's actually very palatable for many home buyers out there. Another great benefit with many of these new construction loan products is that many of them have what's called a float down, which means that if you lock in at a 7% interest rate, but rates end up cooling over the time that you build the property, maybe that's nine months or a year down to 6%, your interest rate will actually be 6% when you close the loan and you start making your regular mortgage payments.

This is actually some pretty great news for people who want to get started on a new build but are also waiting for rates to kind of cool over the next several months. Well, what may happen? We're not sure if the rates are going to continue to stay flat, increase, or cool. There's a lot of indication in both directions that it could continue to increase because the Federal Reserve has said that they're going to increase rates two more times, or it could end up starting to decrease as politics start to get involved, and they need to make it look as appealing as possible in the country as the election starts to get underway.

What does this mean for you?

If you've been thinking about moving and want to sell your home and haven't found a place that you can move to, maybe you want to consider building a new home. Or if you’re a home buyer, and you've been frustrated sitting on the sidelines, even over the past year, or two years because prices are getting involved in multiple offer situations and you actually want to just build your own home, please reach out to a Brooke Team agent. We'd love to show you a few upcoming subdivisions that we have in a number of neighborhoods in Connecticut, Massachusetts, Rhode Island, and in Florida. We're thankful so much for your reading and for staying in tune with what's happening in the real estate market.

For anything that has to do with buying, selling, or investing in real estate, we are your team.

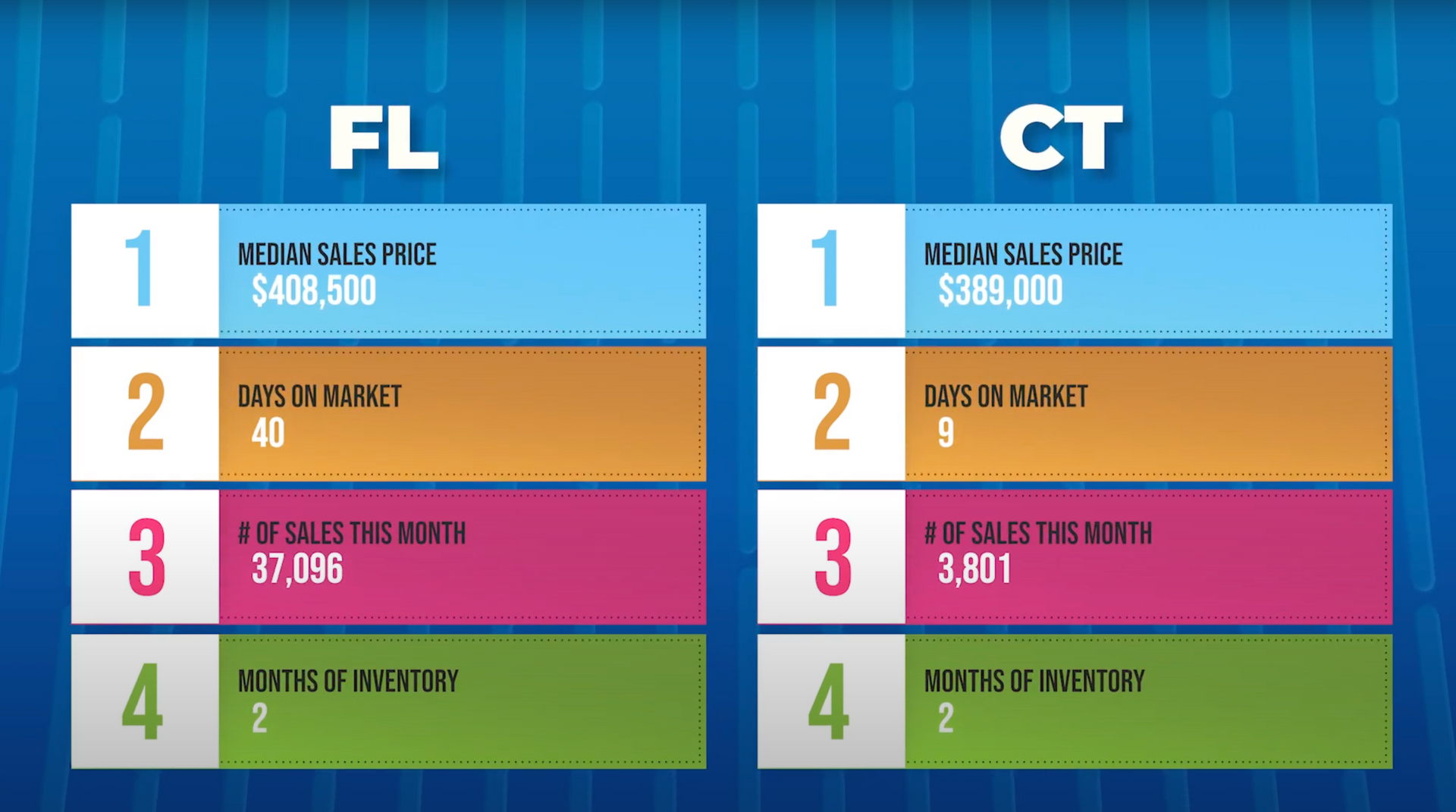

And now, here are the real estate numbers for what's happening in Connecticut, Massachusetts, Rhode Island, and in Florida.

Remember, we're never too busy to serve your referrals. Find on us onFacebook,Instagram, andYouTube.