November Market Update

Our seasons change every year and likely if you've looked outside, you've probably noticed that. If you've also been reading the news or going to the gas pump or to your local grocery store, you've probably also realized that our economy is changing seasons as well. But here's the thing, just as we anticipate winter and spring, fall and summer, we also anticipate the four seasons, or stages, of an economy. Why are we shocked when this happens? Every single year we go outside and I remember, oh I see snow for the first time this year and I get all excited. We go on social media and then we post about it, why do we get so surprised again about the economic cycles when they start to occur? This market update is for you, if you're looking to take advantage of the opportunities that present themselves, whether you're buying or selling a home in the real estate market.

The economic cycles of real estate

So just as we know that they are spring, summer, fall and winter, these are the economic cycles that we actually see happen. We go from EXPANSION into the PEAK. A RECESSION, where the economy starts to retract, which we're getting into now due to these rising interest rates that the federal government wants to occur. And then we're finally going to actually hit a TROUGH.

BUT HERE'S THE GREATEST MYTH OF ALL!!!!! This typical cycle does not signal the end of the world, although it may feel that way sometimes. In actuality, there are more opportunities in recession and troughs than there are in the peak and expansion points of an economic cycle. Let me explain!

How do economic cycles work

The myth is that these sort of economic cycles happen in a linear fashion. We have expansion point that rises up to a peak, we’ll then see some recession as we come down and realize a trough of the end. But the reality is that real estate has not remained the same in value over the course of the last fifty, hundred years, etc. Your grandparents’ house that they purchased has gone through expansion, peak, recessions and troughs, but that real estate is not the same price it was the day that they bought it subject to one of these changes.

The reality is this: we see expansions, peaks, recessions, trough, but they're happening on a line that's constantly increasing. As both inflation impact the cost of hard assets and more demand as population continues to grow causes these hard assets like real estate to continue to rise in value. One of the greatest myths that buyers out there think is, “I'm going to just wait until I hit a trough”. But reality says that a trough today is still higher than the greatest expansion that was in years past.

So, what's the opportunity?

Warren Buffett said it best; “When others are fearful, get greedy. And when others are greedy, be fearful.” And right now, if you turn on the news, what are people right now? They are fearful. So now is an awesome opportunity as we enter into a recession, as we enter into a trough, to actually get a little bit more greedy about real estate and hard assets. Why is that? That's because if you've been paying attention to the news, you've seen things like cryptocurrency, the stock market and other securities see a massive decimation in value over the past few months, just as we predicted months ago. However, real estate is only slightly cooling, but that's due to a cyclical and typical nature of just the fall and winter markets.

In fact, NAR, the National Association of Realtors Economists, says that prices should increase at least one percent if not more over next year. And into 2024, we may see a large rebound in pricing to increase even more. Now, why is that? That simply is because we are still short by about 4 to 5 million units of housing in America. Our population continues to grow and our builders cannot build enough homes and apartments to be able to satisfy the demand for housing. That's why in this recession we might likely see prices of real estate continue to stabilize and even increase despite decimation that happens to cryptocurrencies, stock markets and other securities abroad.

The opportunity in a recession is real estate

So what's the opportunity? The opportunity in a recession is real estate. Hard assets. These are things that you can actually touch, feel, improve. You can go to your property and you can paint it to improve its value. You can add tenants that are paying a higher rent because there's not enough housing and improve its value. There's so much opportunity in real estate. So if you're an investor, this may be a great opportunity to schedule a consultation call with one of our Brooke Team members.

If you're a buyer in this market, this should be helpful information to you, that actually waiting through the season may not be a great opportunity. In fact, most buyers are not fully aware of all the loan products that exist that can actually help them get interest rates in the 4s and 5s of what they love to find for a comfortable monthly payment. Instead, they're paying attention to the news and seeing seven and eight and nine percent interest rates out there. Don't do this!! Instead, schedule a consultation call with one of our Brooke Team agents.

Lastly, sellers, this is for you. It’s still a seller's market even though pricing is starting to cool due to the cyclical nature of the real-estate market into the fall and winter months. There is still a lack of supply in the market and sellers are still selling not only after list price, but also in multiple offers above. Why is that? There's just not enough inventory. If you've considered selling your property, taking advantage of the equity in your home or potentially investing in real estate, now's your time to schedule a call with one of our agents.

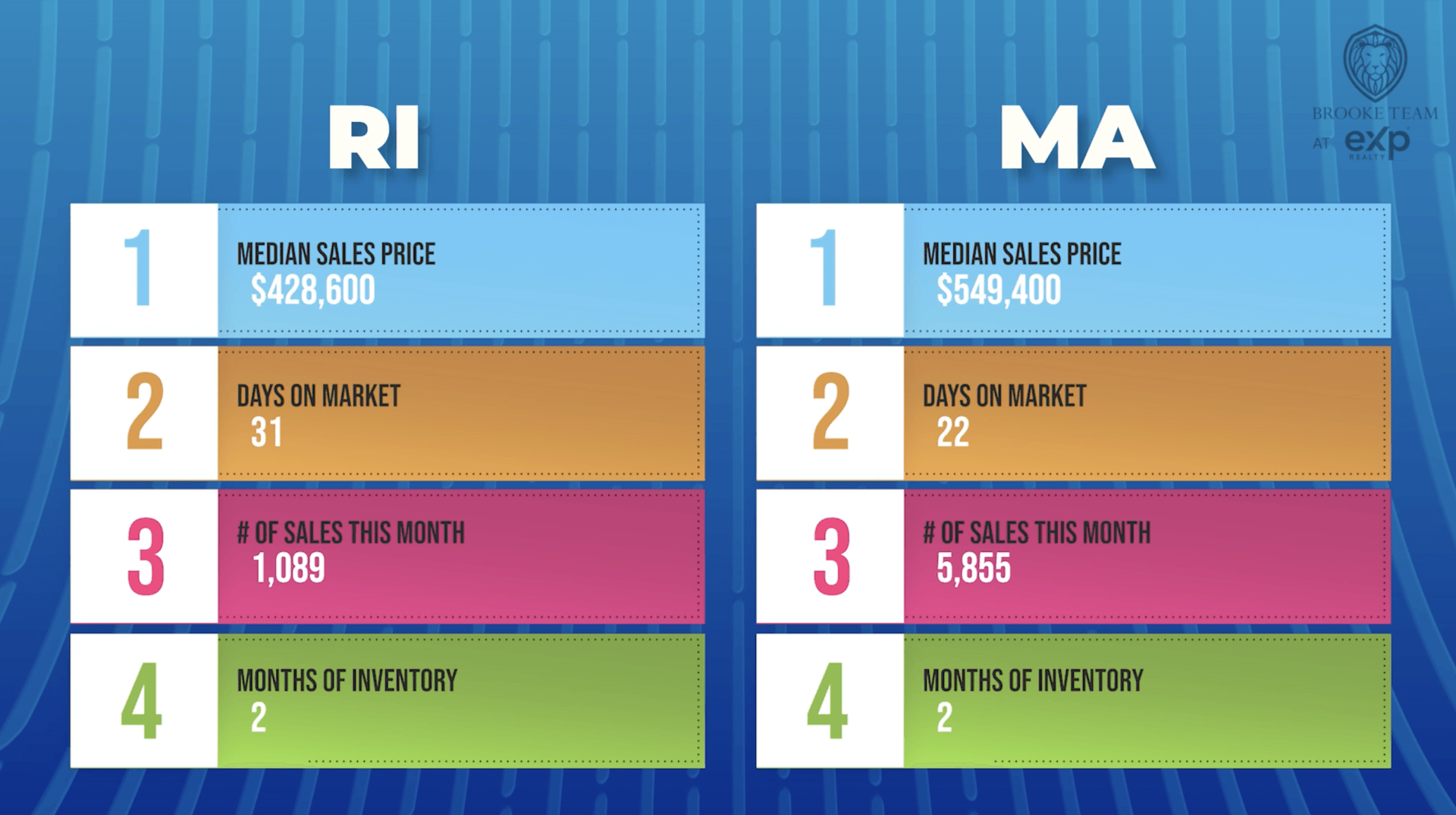

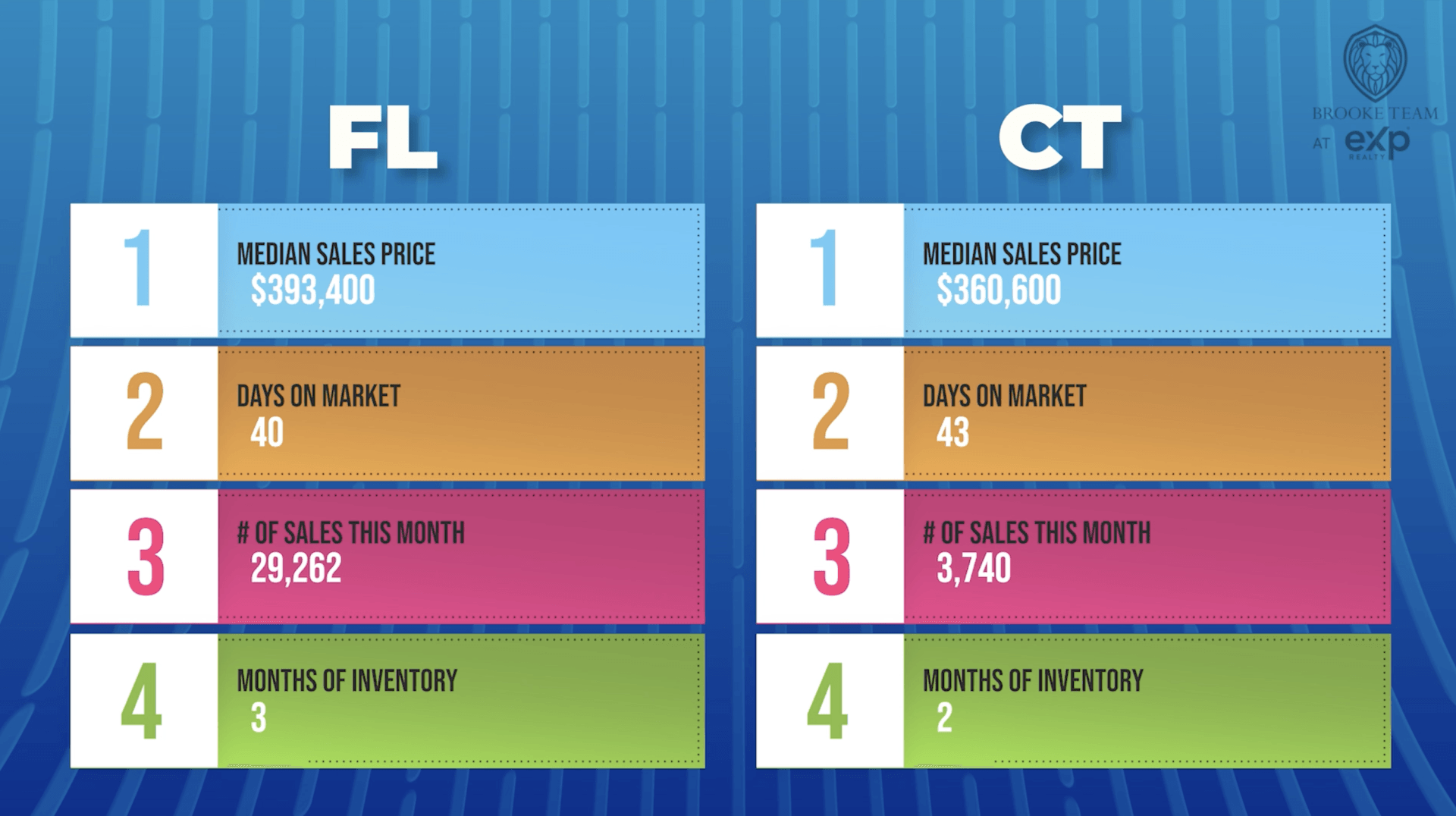

My name is David Brooke and I'm leader of Brooke Team at exp Realty and I'm proud to present to you this market update. Now, without further ado, here's the numbers in real estate for where Brooke Team services clients in Connecticut, Massachusetts, Rhode Island and Florida.

We'd encourage you to reach out whether you're looking to buy, sell or invest in real estate, and remember, we're never too busy to serve your referrals. Find on us Facebook, Instagram, and YouTube.