February 2023 Market Update

Well, either the US government is bad at forecasting or it just doesn't know what's going on in the economy. What I'm talking about is Jobs Report that was just released.

We were expected to have about 150,000 jobs added to the economy, but in reality, guess how many showed up? 517,000 jobs! Which decimates any expectations that we had about the economy or the employment rates. In fact, unemployment decided to dip. This is in response to a US government that has been increasing interest rates on short-term loans in order to slow down the economy. But in reality, the economy is doing fantastic. Well, just to make the numbers even more confusing, ‘inflation’, this big thing that we've been trying to tackle that can actually affect our mortgage interest rates, well inflation just dropped again. Which means that the interest rates are working, which show us that all of a sudden inflation is dropping.

That means that, yes, those prices for eggs are probably going to start to come down along with gas and everything else that we're seeing. But the American economy is strong, which means that jobs are going to keep getting created as long as people have that demand. Well, what happens when you keep creating more jobs and inflation goes down, wages go up and actually mortgages get cheaper, which you bet, this is what's going to happen. Mortgage rates are going to drop and even more buyer demand is going to hit.

Well, how do I know this? Mortgage applications have soared into this new year. So now we're seeing more and more people going out there and talking to their lender and say, “Hey, listen, what can we afford for a house now?” And we're finding that so many are deciding, “Hey, let's jump in and get back into the real estate market”.

FIVE THINGS BUYERS NEED TO KNOW

Well, here are the five things that buyers need to know right now in the market before they go into spring market:

1. You don't need twenty percent down.

There are so many loan programs that can help you get a house. And actually, you might have better use for your money in the investments, in stocks and securities market than to put your 20% down. And what I mean by that is, there are programs out there as low as 0% down and some loans that you could get up to $50,000 in forgivable loan towards your down payment.

2. Do I need any perfect credit? Absolutely not!

There are so many programs out there that are not actually credit contingent. And so there are loans out there where the interest rate is not tied to your credit score. So if that's important to you and you think “Hh, I need like a 750, I need an 800 credit score in order to get this loan”, that's not the case.

3. I have to be at my job for more than two years. That's absolutely not true.

You can be in the same industry or they can show employment history for over two years. So those of you who are thinking about, you know, “I just got a new job, I can't get a loan”, that's not true as well. Absolutely reach out to us. We can connect you with the lender to help you with that.

4. Worry about hurting your credit by talking to a lender

The next thing is, “Hey, I don't want to go and start seeing if I can afford a house right now by talking to a lender because it's going to hurt my credit”. Also not true.

Yes, there are soft pulls on your credit. But in reality, we're going to be able to solve for that. And you can shop around with a number of different lenders so it's not going to affect your credit score that drastically, it’s just a very short term.

5. To get pre-approved by one of our trusted sources

The last one is, “I already have a pre-qualification letter maybe from one of my lenders that I found online versus a pre-approval through one of our trusted sources”. Well, here's the deal. I can go online and type in anything into some online portal that can tell me that I can afford 5 million dollar house. Whether I can or I can't, that's neither here nor there. The reality is though is that the actual talking to a professional is the actual way to do this.

If you were to go on WebMD and say I have a headache, there's a lot of things that they could tell you but talking directly with the doctor, that's going to tell you exactly what's going on with you with a true diagnosis. We'd love to diagnose exactly what you can afford, and what monthly payment is comfortable for you if you're deciding to get into the housing market right now.

WHAT’S HAPPENING WITH SELLERS?

Well, sellers are actually starting to see “Well, wait a sec, can it be a good time to buy and a good time to sell at the same time?” Well, you will pay more for house right now, that's clearly obvious but in the same thought process that our grandparents and our parents paid $100,000 for a house or $25,000 for a house that now sells for $400,000… $500,000, a million dollars. Guess what? The same exact thing is happening right now. Because we're short of so many housing units in America, those prices on existing units are starting to rise and the cost to build is also rising. What America needs right now is houses more than ever.

So sellers, you're in an excellent spot in order to sell a house on the market right now. And, although, over the past few months, things really changed around and cooled for sellers, because interest rates were so high. Now that they're coming back down, get ready for an EXTREMELY HOT SPRING MARKET.

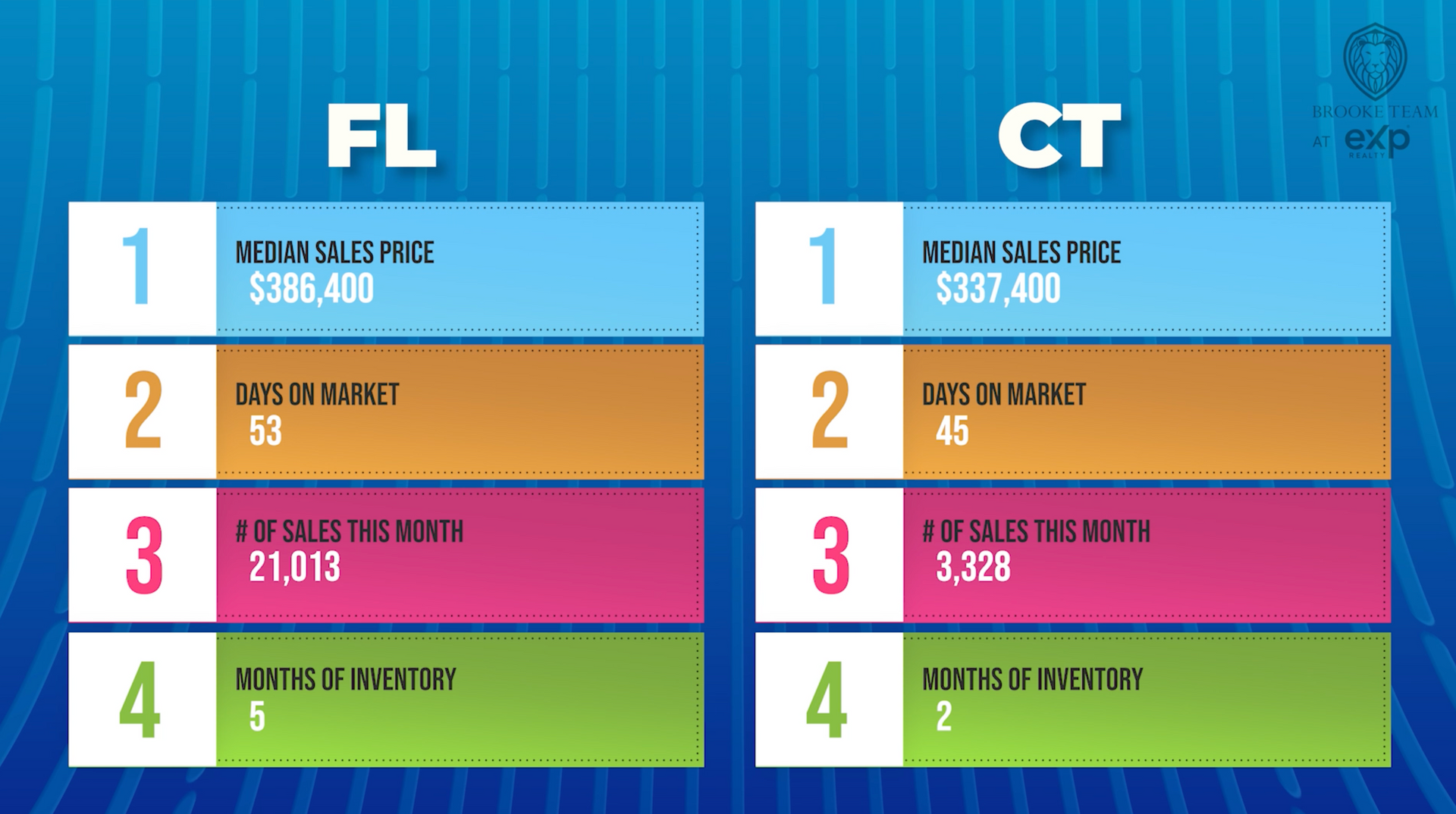

I can't say this enough. If you're about to buy a house, talk to us now because it's going to heat up really quickly. And if you're about to sell a house, I don't care whether it's in Connecticut, Massachusetts, Rhode Island or Florida, have a conversation right now with us before we get into spring market, so we can accurately set up a plan in place for you so that when you're ready to list a house you can do so really quickly. We want to actually start getting you looking for houses now, so can find the house of your dreams and we could sell your house super quick when it's time to actually move.

Buying, selling, investing in real estate in Connecticut, Massachusetts, Rhode Island, and Florida, has never been easier. Our team of Brooke Team agents are highly trained in order to find you the best deals whether on or off market. So, if you've been thinking about buying, selling, or investing in real estate in 2023,

reach out now.