April Market Update

One of the tools that bartenders have in order to keep you safe, is that they can cut you off if you drank too much. That's exactly what's happening now with interest rates.

Buyers and sellers in this market are wondering “Why are interest rates increasing?” They're going for a pre-approval and then all of a sudden, they're seeing that, “Wow, I used to be pre-approved for maybe a 3.5% interest rate and now all of a sudden it's near 5%. Now, historically speaking, that's still very good, but they’re trying to understand why is this occurring? Well, in 1955 a federal chairman described it this way: his name is William McChesney Martin Jr and he said that basically raising the interest rates is like a chaperone going to a party and taking the punch bowl before everything gets too crazy.

Well, that's exactly what's happening right now. You know, over the past couple of years, the government's printed a lot money, 1.9 trillion or more. At this point, the economy is starting to rock and roll and what's a danger right now is actually inflation. In order to stop that, the government, just like a bartender, is trying to slow down the movement of money and when they do that, they can actually incorporate the rising interest rates as a way to slow things down. It's actually good thing. It's actually healthy and what's needed now in market. Now, that's still great when you look at things historically, but you need to know that the cost of money has now increased.

What's that doing for the sellers in the market?

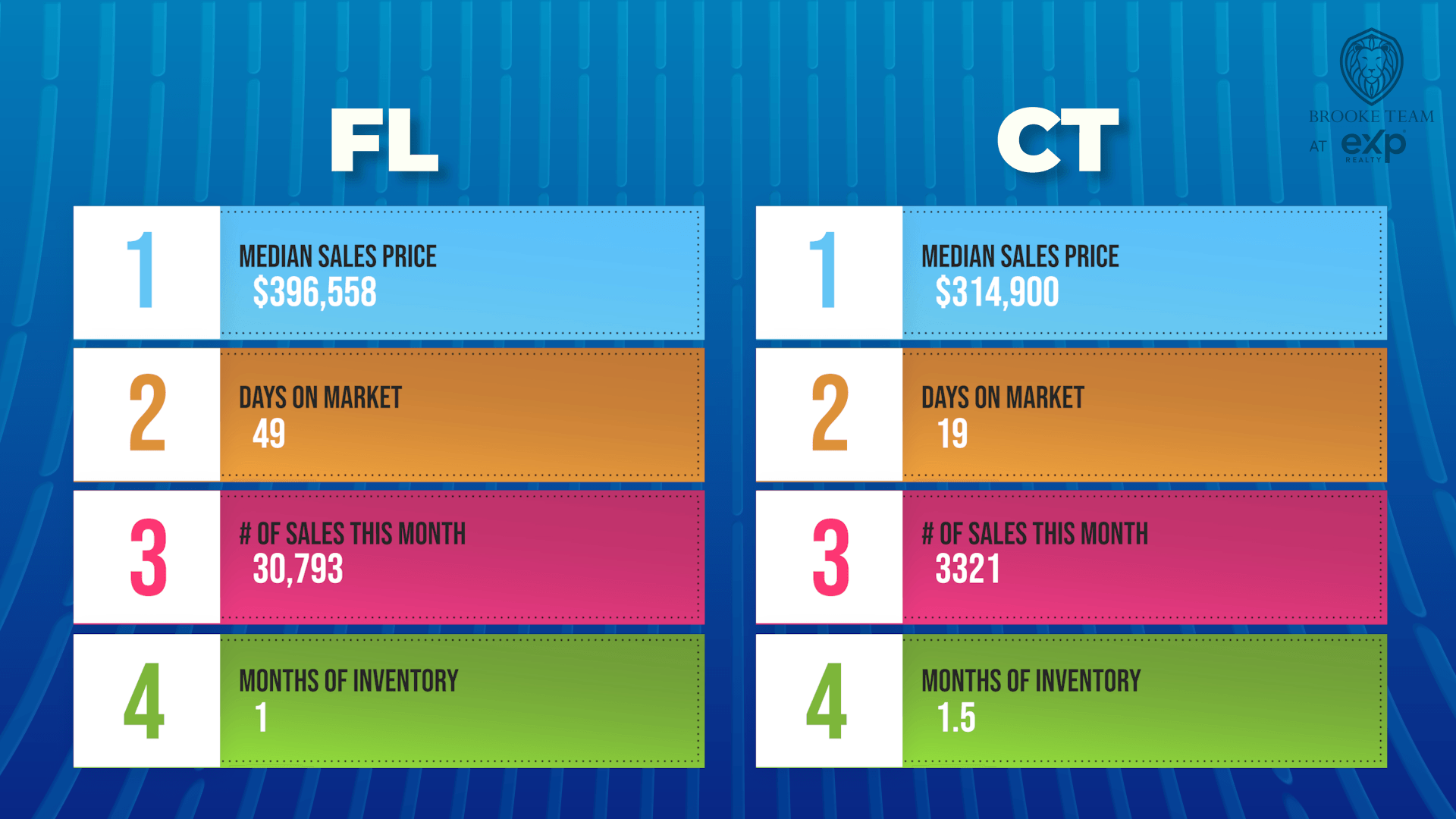

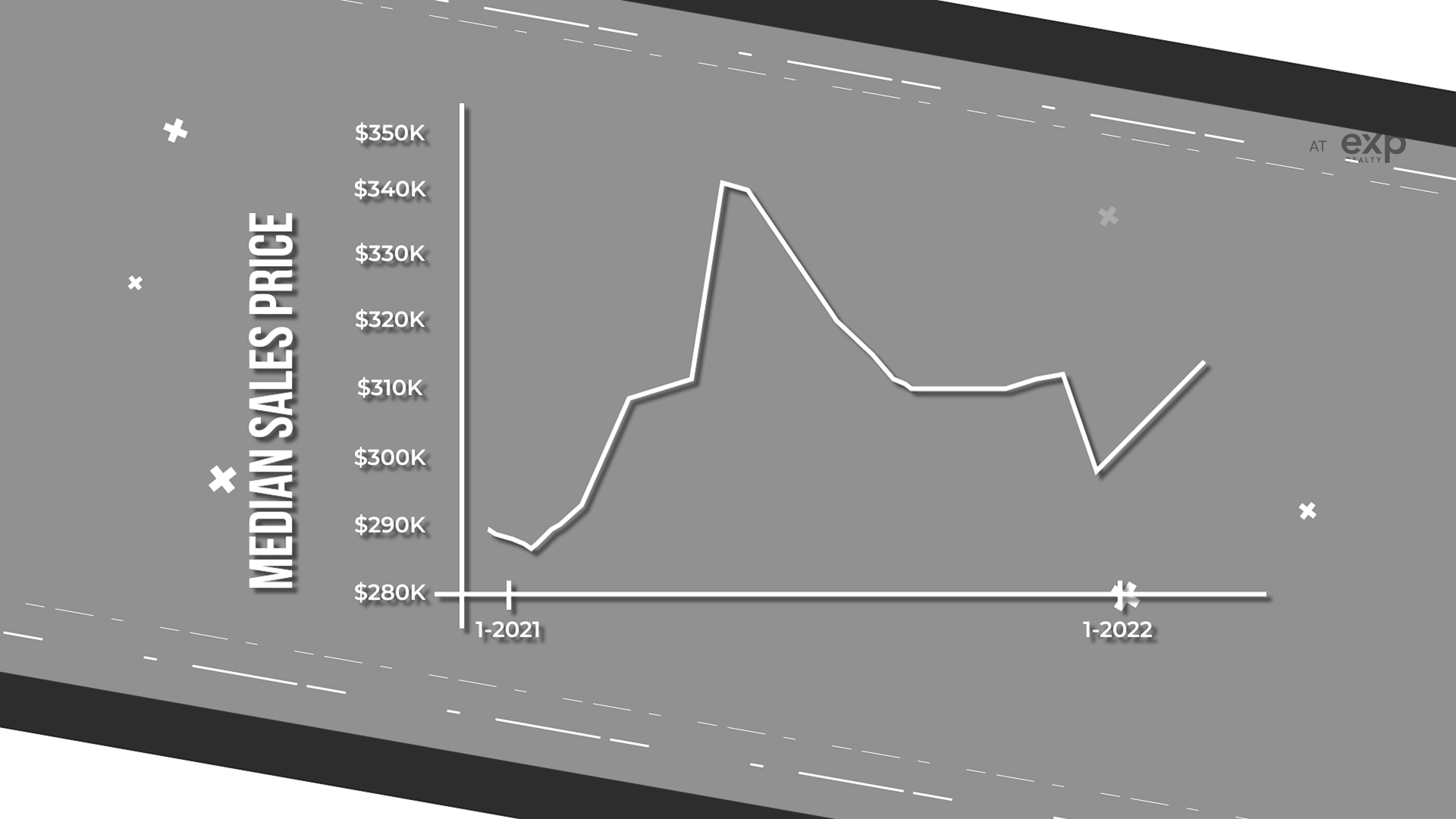

Prices have actually not only increased a little bit, but they started to stabilize in certain towns. So what does that mean for the future? Does that mean that the real estate prices are now going to stabilize? Well actually, not necessarily. In Connecticut, we saw sale prices reduce over our Zenith point last year of $340,000 down to $300,000 as of February. Now going into March and into April, we're seeing those real estate median sales prices increase about another 5% to about $315,000.

Days on market started to drop again, as the spring market is now kicked into full gear. We're also seeing inventory still stabilizing about a month-and-a-half. What's that mean? Buyers are in gear regardless of these interest rates coming back. What does that prove? You’ve still got very strong demand in the market. Still an excellent time to sell.

What does that mean for you as a buyer?

If the interest rates have been rising and you've been concerned about that, you want speak with your mortgage pro sooner than later. Hopefully, you can lock in an interest rate that's still attractive. Even if they do go up, we're still going see historically low rates in retrospect to rates of what they were maybe when we first were buying houses. I know mine for a fact was at 6-7% when I bought.

It's time to celebrate!

Well, here's a reason to celebrate regardless of rising interest rates. I'm proud to announce that Brooke Team is not only able to service clients in Connecticut, and Massachusetts, but we've now, as of this month, launched in Rhode Island and in Tampa, Florida. So, if you, friends or family or referral partners are looking to do business in either Rhode Island or in Tampa, Florida area, we can't wait to introduce you to our wonderful team members.

And now, without further ado, here are all the sales numbers for Connecticut, Massachusetts, Rhode Island and Florida. Have a great day, everyone.